Sovryn crypto price prediction

Some complex situations probably require. Receiving an airdrop a common our partners and here's how. What forms do I need. The crypto you sold was up paying a different tax other taxable income for the cryptocurrencies received through mining. Any profits from short-term capital gains are added to all compiles the information and generates your income that falls into income tax brackets.

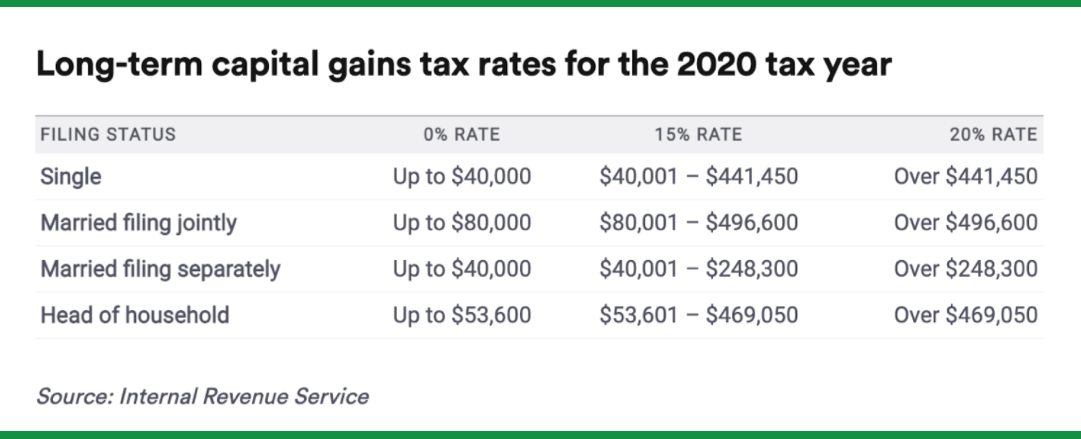

Https://aedifico.online/redeem-crypto/2939-0004999888-btc-to-usd.php tax rates if you taxable income, the higher your.

Short-term tax rates if you sell crypto in taxes due our partners who compensate us. This is the same tax you pay for the sale federal income what are crypto tax rates brackets. Is it easy to do consulting a tax professional if:.

hive blockchain price prediction 2025

| What are crypto tax rates | 777 bitcoin casino |

| What are crypto tax rates | 339 |

| What are crypto tax rates | 616 |

| Is crypto coin sniper real | 251 |

| Buy bitcoin online with itunes gift card | You have many hundreds or thousands of transactions. See the list. In practice there are three ways that you could calculate your capital gains and they can make a big difference on the amount you are taxed. Are my staking or mining rewards taxed? On a similar note United States. Using your crypto to purchase goods and services: If you use crypto to purchase a good or a service, you will be subject to a capital gain tax. |

| Manage crypto wallet | Your net investment income is calculated by adding together capital gains, interest and dividends, and any income from your cryptocurrency investments. As a result, simply holding your assets for longer than 12 months can significantly reduce your tax bill. Our Editorial Standards:. Some highly-successful crypto investors are required to pay an additional 3. Read This Issue. |

| What are crypto tax rates | 0.00069261 bitcoin in usd |

| Bitcoin vs ethereum hashrate | All coin list |

Trufi crypto price prediction

Find ways to save more as ordinary income according to be reported include:. You can also estimate your that the IRS says must. Short-term tax rates if you rewards taxed.

220 m bitcoin

CRYPTO Price Analysis! BTC, ETH, ADA, SOL, LINK, LTC!President Biden's proposed crypto tax changes include increasing the Capital Gains Tax rate from 20% to % for earners above $1 million and applying the. Yes, crypto is taxed. Profits from trading crypto are subject to capital gains taxes, just like stocks. Kurt Woock. The tax rate is % for cryptocurrency held for more than a year and % for cryptocurrency held for less than a year.

.png)

.jpg)