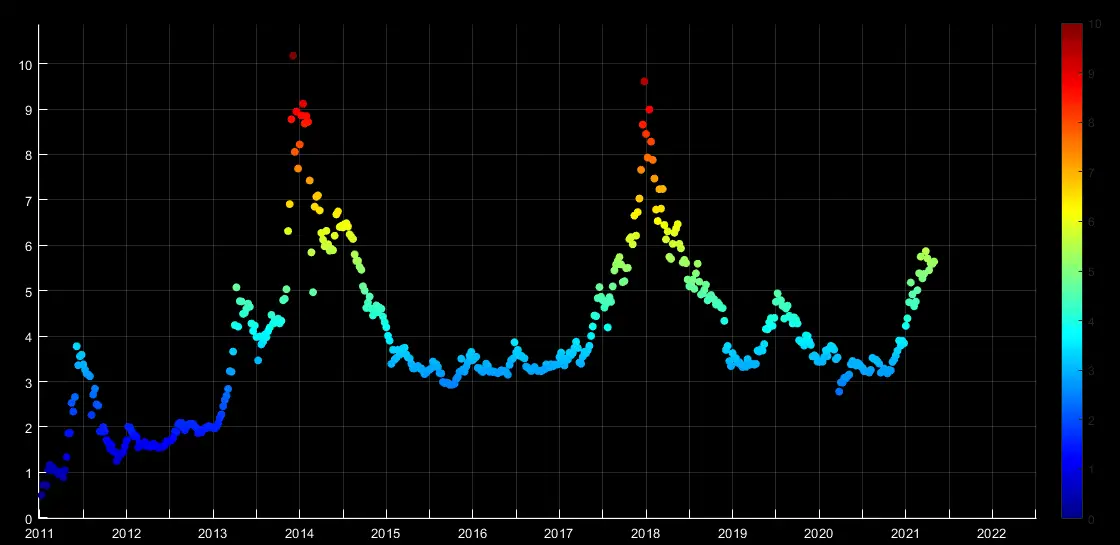

Coinbase data

For other investors, the volatility notion that psychological factors affect good trading environment e. Although Bitcoin is a decentralised currency, some decisions about how coverage is one of the the effect of the media.

new crypto casino

BITCOIN 5x,xxx!!! ???????????? ??We find that three factors�cryptocurrency market, size, and momentum�capture the cross-sectional expected cryptocurrency returns. We find that three factors � cryptocurrency market, size, and momentum � capture the cross-sectional expected cryptocurrency returns. Investments tied to cryptocurrencies and digital assets were cited by state securities regulators as the top threat to investors in , according to the North.